Mar

March 2nd | What do Bank of Canada rate hikes mean for you?

On March 2nd 2022, the Bank of Canada increased interest rates for the first time since 2019; overnight rates increased to 0.5%, interbank rates to 0.75%, and the deposit rate to 0.5%. With rates on the rise and Royal Bank of Canada senior economist Robert Hogue predicting rates to continue rising until 2023, property owners are questioning how these might impact their mortgage payments and property markets overall.

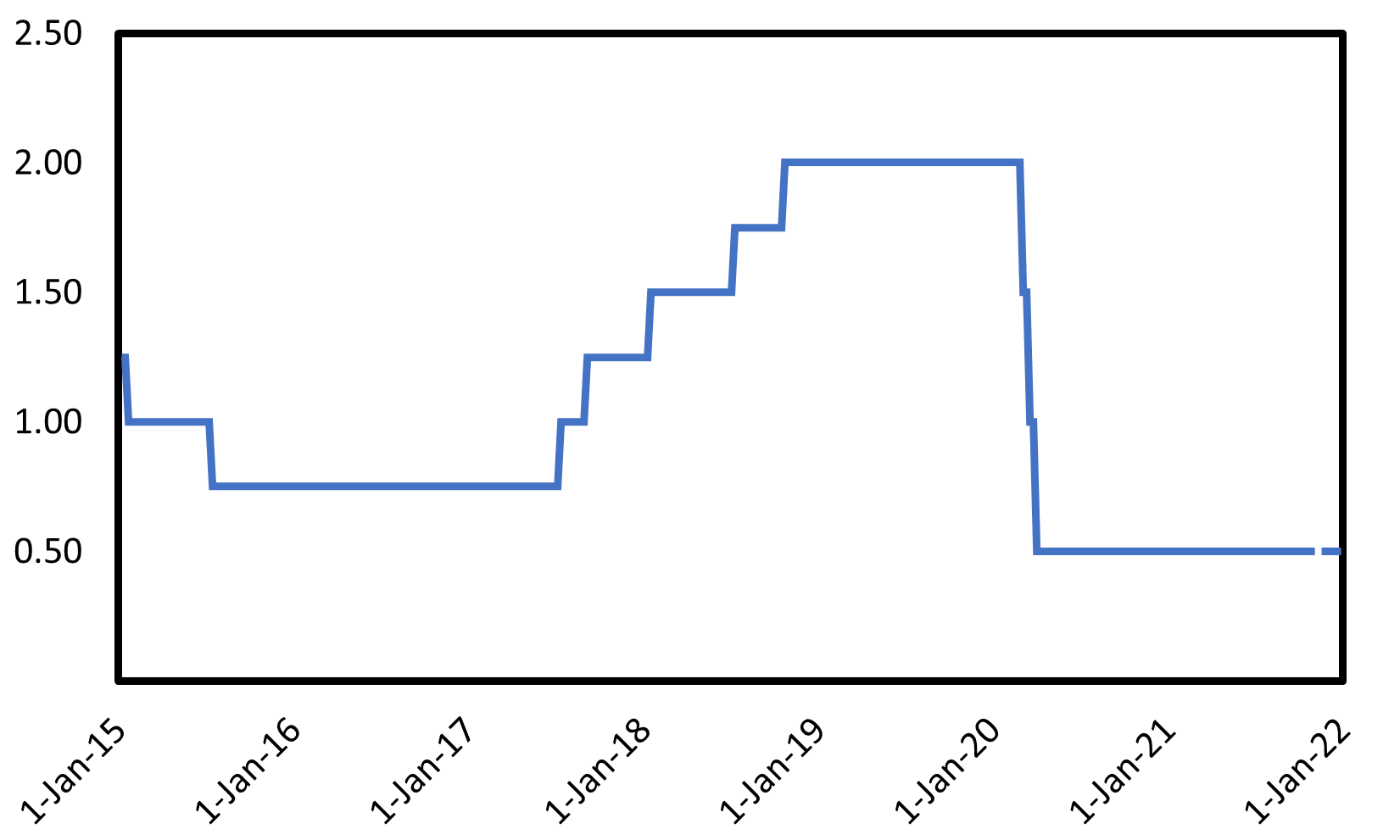

That said, with the Bank of Canada (BoC) having reduced rates to 0.25% in 2019 to offset the effects of the pandemic, these rate hikes were not unexpected, and were scheduled to increase once inflation returned to its 2% target. Although the BoC had predicted that the recovery would take until 2023 until rates would need revising, the bank has recently amended its recovery target claiming that it is likely to take place sometime in Q2-Q3 2022. Further, the BoC speculates that with the ongoing global recovery, appreciating commodity prices including oil are likely to support the Canadian dollar as it continues to gain strength versus its counterparts. These rate hikes will surely impact homeowners according to Royal Bank of Canada senior economist Robert Hogue, with the aggregate effects of these policies depending on the type of mortgages homeowners have.

Bank of Canada interest rates, 2015 to 2022.

The BoC acknowledged that housing trends in the Canadian markets are the result of very strong demand over scarce supply, claiming that this alone has contributed to economic recovery in 2021, with these trends holding strong in the beginning of 2022. National home sales appreciated 1% month-over-month in January, the MLS® Home Price Index appreciated a record breaking 28% year-over-year, and new listings (supply) is down 11% from December 2021 to January 2022.

As such, chair of CREA Cliff Stevenson questioned whether “supply [will] be overwhelmed by demand as it was last spring, or will we start to see the re-emergence of some of the many would-be sellers who have been hunkered down for the last two years? Either way it is shaping up to be another interesting year for the housing market, and your local REALTOR® has the information and guidance you’ll need if you are planning on buying or selling in 2022.” Further, CREA senior economist Shaun Cathart stated that if such a surge of sellers would emerge in upcoming months, “we’d likely see a massive number of sales take place which would get a lot of frustrated buyers into homeownership… Those are all things this market needs. It really comes down to how many properties come up for sale in the months ahead.”

Media Relations, The Lind Realty Team.

Do you have any questions concerning Ontario housing markets, or on the value of your home? Contact us, to learn more!

Bank of Canada (2022). Bank of Canada increases policy interest rate. Bank of Canada. Retrieved from https://www.bankofcanada.ca/

Bank of Canada (2022). Policy interest rate. Bank of Canada. Retrieved from https://www.bankofcanada.ca/

CREA (2022). National statistics. February 2022 News Release | CREA Statistics. Retrieved from https://creastats.crea.ca/en-CA/

Ferreira, J. (2022). How interest rate hikes could affect your mortgage payment. CTVNews. Retrieved from https://www.ctvnews.ca/